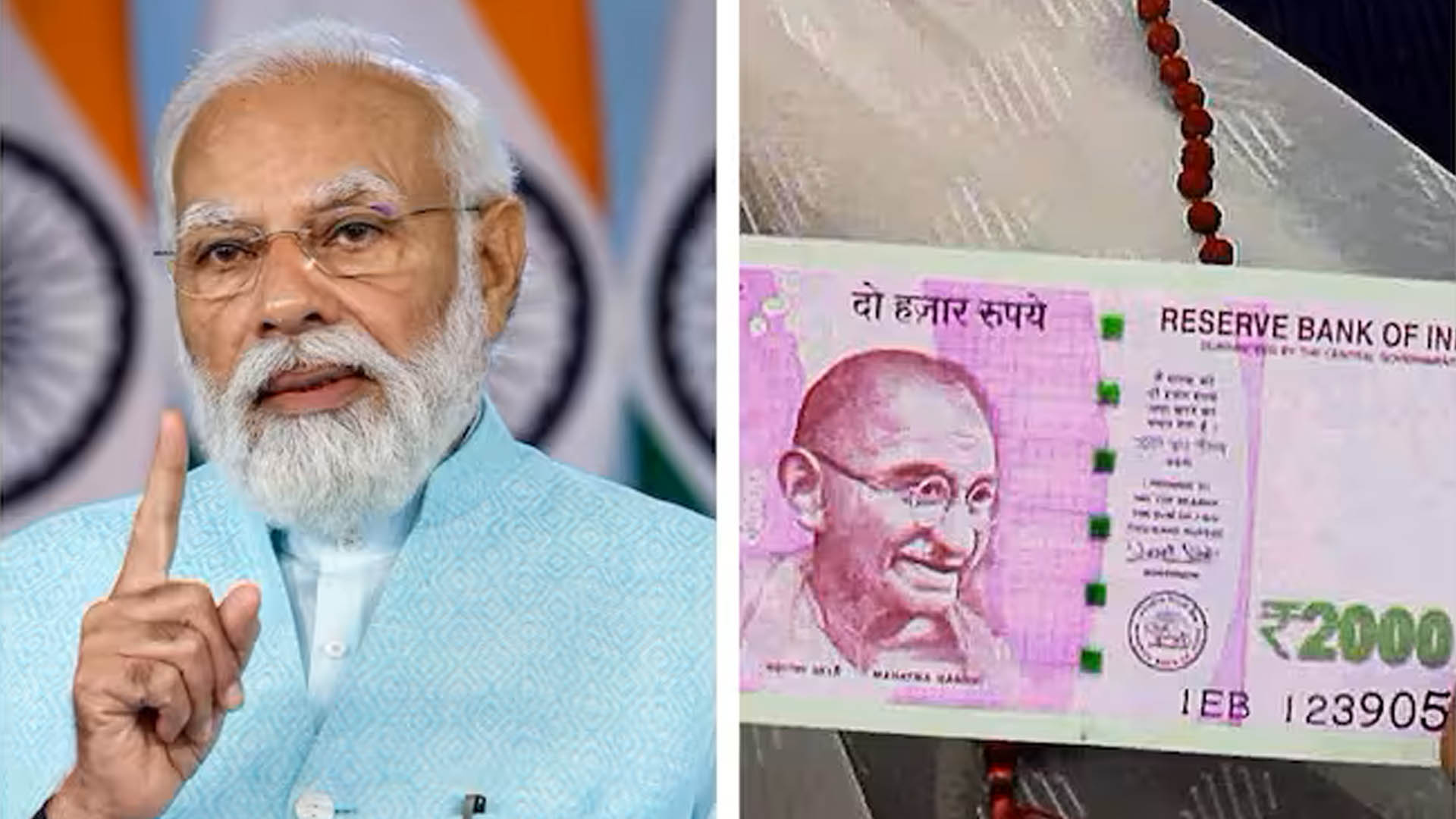

Rupee Two thousand Notes will soon become a history

Omkar Dattatray

Demonetization in Indian economy had taken place six years ago on 8th November 2016 and the motive was to curb black money. But this step and decision of the RBI under the political authority’s direction of Modi government was taken by the political parties and the general public differently and it in fact was a mixed bag of good and bad.

That decision was opposed by the congress and other opposition parties, while it was welcomed by the BJP. However, one thing is clear and loud that this hard economic decision put the common man to great inconvenience which though was for short period.

Now after more than six years from the demonetization, the RBI again took a drastic and big decision to put rupees two thousand notes out of circulation. In a surprise move, the RBI announced the withdrawal of Rs 2000 currency notes from circulation but gave the public time till September 30 to either deposit such notes in accounts or exchange them at banks. The reactions to the RBI decision start pouring in from political parties.

The move has been widely criticized by the political parties across the spectrum. The decision will ultimately reduce the quantum of black money in the economy. The objective being the same to curb the black money, but one wonders will this decision of the RBI curb the black money or will it only put the general public to hardship and inconvenience.

The current decision of stopping the circulation of the notes of 2,000 denomination can be called mini demonetization.RBI has clarified that the Rs 2000 notes will remain in circulation only up to 30th September 2023 and the people can exchange their Rs 2000 currency notes between 23rd May and 30th September. On a single day the currency notes of can be exchanged up to 20 thousand rupees only.

The Reserve bank of India (RBI) on May 19 decided to withdraw Rs 2000denomination banknotes from circulation in pursuance of its clean Notes Policy. However, Rs 2000 notes will continue to be legal tender up to 30th September.

A similar withdrawal of notes from circulation was undertaken in 2013-14. It is the reminder of the demonetization days when the banking channel was overwhelmed by the massive crowd thronging into the branches to exchange banknotes ,the decision to withdraw Rs 20000 notes is also likely to strain the system besides creating anxiety and inconvenience to the public .The central bank has advised the public to deposit Rs 2000 notes into their bank accounts and /or exchange them into banknotes of other denominations at any branch .

Deposit into bank accounts can be made in the usual manner ,that is ,without restriction and subject to extent instructions and other applicable statutory provisions as per RBI .For operational convenience and to avoid disruption of regular activities of the banks ,exchange of Rs 2000 notes into banknotes of other denominations can be made up to a limit of Rs 20,000 at a time at any bank starting from May 23,2023.To complete the exercise in a time bound manner and to provide adequate time to the members of the public ,all banks have been directed to provide deposit and / or exchange facility for Es 2000 notes till September 30,2023.

The RBI has issued separate guidelines to the banks. The facility for exchange of Rs 2000 notes up to the limit of Rs 20,000 at a time will also be available at 19 Regional Offices of RBI having Issue Departments from May 2023. Banks have been asked to stop issuing Rs 2000 notes with immediate effect. Members of the public are encouraged to utilize the time up to September 30,2023 to deposit and /or exchange the Rs 2000 notes.

It is pertinent to mention that Rs 2000 banknote was introduced in November 2016 primarily to meet the currency requirement of the economy in an expeditious manner after the withdrawal of the legal tender status of Rs 500 and Rs 1000 banknotes in a circulation at that time .The objective of introducing Rs 2000 notes was met once banknotes in other denominations became available in adequate manner.RBI said that the total value of these banknotes in circulation has declined from Rs 6.73 lakh crore at its peak as on March 31,2018 .It has been observed that this denomination is not commonly used for transactions .

Further the stock of banknotes in other denominations continues to be adequate to meet the currency requirement of the public .Earlier printing of Rs 2000 banknotes was stopped in 2018-19 .Ac majority if the Rs 2000 denomination notes were issued prior to March 2017 and at the end of their estimated life –span of 4-5 years .It has also been observed that this denomination is not commonly used for transactions .Further the stock of banknotes in other denominations continue to be adequate to meet the currency requirement of public .

Besides the idea behind the stopping of the circulation of Rs 2000 notes is combat the black money as it is the banknotes of big denominations that the unscrupulous elements keep the black money and so to address this problem the decision to stop the circulation of the banknotes of Rs 2000 denominations has been taken .Thus in view of the above and in pursuance of the’ Clean Note Policy’ of RBI ,it has been decided to withdraw the Rs 2000 denomination banknotes from circulation .It should proper to mention as to what is the clean note policy .

The hard decision to stop the circulation of Rs 2000 banknotes has been rightly criticized and opposed by the congress and other opposition parties because as per these opposition parties the decision will put the general public to great inconvenience as it was the experience of the people when demonetization was announced in 2016.The present decision to stop the circulation of Rs 2000 banknotes seems to be not economically wise and therefore the RBI should not have taken such decision which seems to be anti people .

The decision to ban the circulation of Rs 2000 banknotes is aimed at curbing the menace of black money but it is the million-dollar question that will this decision help in addressing and fighting the scourge of black money which has assumed enormous proportions. According to Rajasthan CM Ashok Gehlot government should reveal the intention behind stopping the circulation of Rs 2000 notes. The RBI should take other monetary and fiscal measures to arrest the growing trend of black money and then and only then can the country be successful in curbing the ever-growing black money otherwise not.

The Modi government should put to application monetary, fiscal and other economic measures to address the gigantic problem of black money which has created parallel economy in the country.

The public should not feel uneasy as a result of this decision of stopping the circulation of banknotes as it will not affect the transaction capacity of the common man as it will remain unaffected and thus the general public should welcome hard economic decision of RBI. To put it rightly due to the RBI decision the Rs 2000 notes will soon become a history.

(The author is a columnist, social and KP activist)